We often stick with the same bank account for years and miss out on great opportunity to save money on service charges and interest rates.

Taking Care of Money can have a big impact on our future whether it is big or small.

There is a number of online banks that offer both checking and savings accounts, credit cards, loans, and other investment options.

Unless you specifically need help from the teller service and physically going to these banks to manage your account the online banks are a great alternative to save fees.

Banks have different kinds of accounts. Chequing accounts and savings accounts are two common bank accounts. You can open an account for yourself or a joint account with your spouse or another person.

Banks may charge you fees for some of their services. Here’s some information on how chequing accounts work, their associated features, and how to choose the right one based on your needs.

What is Chequing Account?

Chequing Accounts are meant to serve as transactions account for everyday spending. Most people have at least one chequing account with a financial institution so that they do not have to carry much cash when making purchases.

chequing accounts are typically easy to set up with a very low minimum balance. Also, checking accounts offers the same level of safety.

Be sure to read all the terms associated with the chequing account before signing up.

Almost all credit unions and banks offer chequing accounts.

What are the common features of a chequing account:

Deposits – You can deposit money any time. Most people have their pay check deposited into checking accounts.

Withdrawals: You can withdraw money at any time by going to an automated teller machine (ATM), using a debit card, writing a check, paying bills online, or filling out a withdrawal form at your financial institution.

Pre-authorized payments (mortgage, utilities, Rent, etc.)

Fees: It varies based on the financial institution and selected features. If it says “Free” chequing account, what does that means? You still need to look at the fine details. Is there a charge for an overdraft?

Interest: The big disadvantage of chequing accounts is that they often pay little-to-no interest. However, there are more and more financial institutions do pay better interest in chequing or savings plus accounts these days. It’s your hard-earned money and why not shop around.

Debit Card: Financial institution may give you a debit card to use for your chequing account. You can use your debit card to pay for something at a store and the money will automatically be taken out of your checking account to pay the store

Transfers (between two users of the same or different lending institutions)

E-mail money transfers between two users of different lending institutions (both send and receive)

What is Canada Deposit Insurance Corporation (CDIC)

If you put money in a bank or credit union that is a member of the Canada Deposit Insurance Corporation (CDIC) then your money is protected up to $100,000 in case of a bank failure. When choosing a financial institution, make sure it is a member of the CDIC. It is also important to understand what type of bank accounts are covered. Savings and chequing accounts are usually covered. For more information, visit Canada Deposit Insurance Corporation(CDIC) website.

How to select a Financial Institution

The main factors are Convenience, Fees, and Services. It is important to identify the banking services that are most important to you.

How do you perform your banking: mostly in-person or online?

Internet-based financial institutions tend to pay a higher interest rate on deposits than institutions with physical branches because they have lower overhead expenses. Customers must weigh these higher interest rates against the lack of access to branches and other local services.

How often do you visit your financial institution? If you do this often, you may want to consider the location and hours of operation for the financial institution.

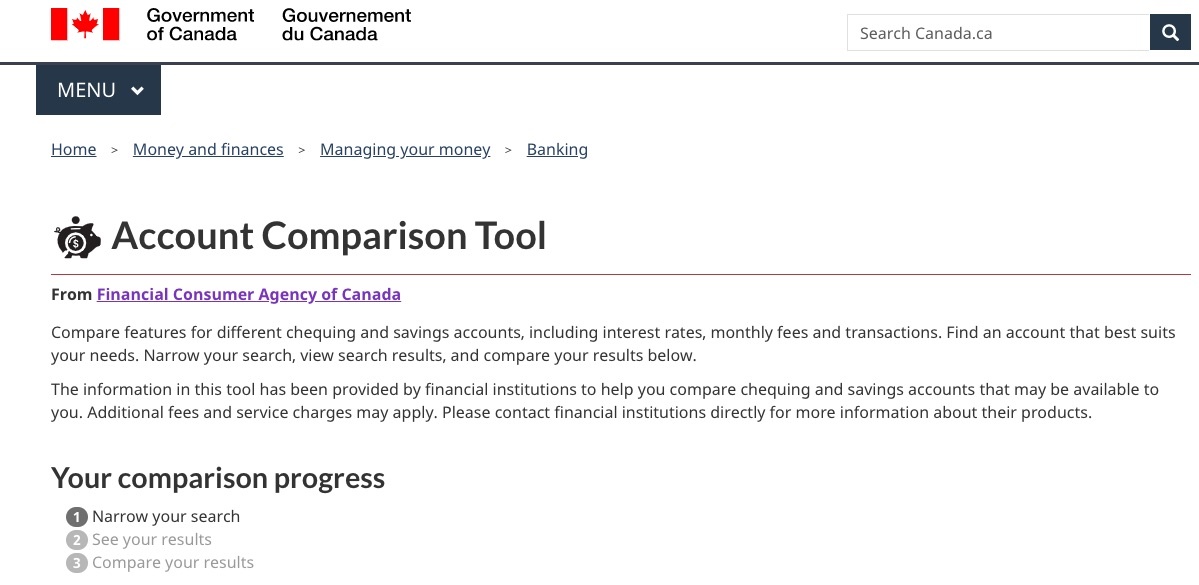

Compare the features for different chequing and savings plus accounts, including services, monthly fees, coverage, interest rates, and locations of financial institutions before you open an account so you can choose one that best meets your needs. The following Government of Canada website provides a Bank Account Comparison Tool that may help you to find the banking package that fits your needs.

How to compare Chequing Accounts?

The government of Canada has had an account comparison tool. Determine which financial institution will provide you with the best banking services using these Bank comparison tools.

Here are a few items to consider when choosing the chequing account:

How many transactions do you make in a typical month?

Many financial institutions offer no-fee-unlimited transactions, be sure to look at some of the no-fee chequing accounts

Note that if you select the basic account and performed more than the specified number of transactions it includes, you’d be charged for every transaction you go over and it adds up fast!

Most of the chequing accounts with large banks pay only very little interest on deposits. You should compare the interest rate on the deposit. This website seems to provides a comparison of what chequing accounts rates you could earn based on your deposit amount and where you live.

https://www.canada.ca/en/services/finance/tools.html, Click on “Bank Account Comparison” Tool

https://www.ratehub.ca/chequing-accounts

Recently few web-based financial institutions have introduced Hybrid (Savings Plus) accounts that both earn interest and provide chequing account services like bill pay, Interac® e-Transfer, etc. A good example is EQ Bank with 1.5%.

Financial institutions vary on the minimum required balance needed to earn interest.

If you are already doing most of your banking online you may want to capitalize on the higher rates at web-based financial institutions.

We narrowed down a few banks only considering chequing accounts that charge no monthly maintenance fees.

Here are a few examples of a web-based bank that I have tried personally with good experience.

Note: These rates are subject to change at any time, many banks are changing their interest rate without notice. Please refer to each bank’s landing page for the most up-to-date information.

1. Tangerine’s unlimited chequing account

Tangerine offers free checking account, there are no monthly fees, great online tools including mobile cheque deposit, unlimited transactions, competitive e-transfer rates, and ATM access through Scotiabank’s ATM network. It also costs $0 per month.

Although Tangerine is mainly an online bank, you still have access to the Scotiabank ATM network of over 4,000 machines across the country.

2. EQ Bank Review

EQ Bank’s Saving Plus account consistently offers high interest at or near the top of the market. It pays 1.25% percent interest on a savings account without taking into consideration a minimum required balance. This means that every dollar you deposit earns interest.

3. Simplii

Simplii financial offers free daily banking with the following excellent features:

- Unlimited free paper cheques

- You can earn interest on the balance in your account. Tiered interest rate of 0.05% to 0.50%,

- Unlimited free transactions

- No Monthly fees

- Bill payments and deposits are free

- Unlimited Interac e-Transfers

- Access to telephone banking

- Simplii account holders have access to their money through CIBC’s network of more than 3,400 ATMs across Canada.

Additional fees and service charges may apply so my recommendation is to contact financial institutions directly for more information about their products.

Canadian Chequing Account Comparison

| Bank | Account Type | Transactions | Monthly Fee | ATM Card | Interest | CDIC Member | Comments |

|---|---|---|---|---|---|---|---|

| EQ Bank | Hybrid(Savings Plus Checking) | Unlimited | 0 | No | 1.5% | Yes | No Monthly Fees, No minimum balance, Free electronic transfer, Unlimited free Interac e-Transfers |

| Tangerine | Checking | Unlimited | 0 | Yes | 0.15% | Yes | No Monthly Fees, No Minimum balance |

| Simplii | Checking | Unlimited | 0 | Yes | 0.05 | Yes | Best No Fees, with no minimum balance |

Frequently Asked Questions

Learn How it Works!

What are the bank chequing account Fees?

“Free” checking account usually do not charge monthly fees or have a minimum balance to open an account. However many of the credit unions and banks offering free checking accounts still charge for items like overdrafts.

Why online bank is good alternative?

Online checking accounts can offer several benefits over accounts at traditional brick-and-mortar banks.

In most cases, online banks offer a large selection of digital features than traditional banks to help manage your money quickly.

Many of the big banks (brick-and-mortar) offer a bonus to open new accounts. Most of these accounts have monthly fees and require a high minimum balance to waive those fees. Also, the interest rate is very low compared to some of the online banks like EQ bank.

Although these accounts with bonus appealing in the short term, it may not be much beneficial in the long term for your investing.

You should try to invest in accounts that grow and save your money.

What is overdraft?

Banks offer this overdraft protection as a service to cover purchases that you can not pay due to a low account balance. If you sign up for overdraft protection you may not have to pay the NSF fee and the bank will cover the funds but there may be other fees for overdrawn. It can vary for different banks.

Instead of taking the overdraft protection, check whether they offer an overdraft line of credit with a low-interest rate if one is available

you may want to check whether you can link another account, like a savings account to our checking account so funds can be automatically transferred as necessary.

0 Comments